Here’s how business and money went in our February Nomad Income Report. If this is your first layover with us, see also our January Nomad Income Report.

As you may have read in our Podcast Spotlight, February was a sluggish month for me. The tropical heat is just not conducive to work, as least for me, and I was paralyzed by planning and sourcing which yielded little in terms of tangible assets.

Fortunately, I got a second wind at the end of February and have built on that momentum leading into March. A few things “clicked” for me in the final week of February. I internalized the idea that success is ultimately determined by the amount of value one creates, as opposed to pure passion, and that failure is feedback, not a barrier.

This is all rhetoric until these ideas are truly internalized. Two things helped me achieve this, the first was the thought of returning to corporate life and carrying on with our lives in the “safe” and predictable bubble that is the American life. No thank you. The second was understanding the journey ahead, and more specifically the lifecycle of start-ups.

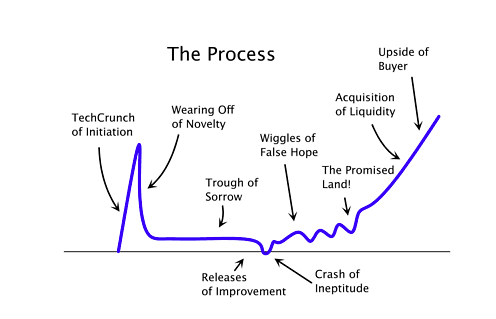

At Amazon, I moved between start-ups about every two years, entering at an early stage of their growth. Each of them had a predictable lifecycle that was both painful and rewarding. Paul Graham drafted his observation of the start-up lifecycle back in 2011 and I’ve shared it with every one of my teams since.

I spent the majority of my Amazon career working in the trough of sorrow and building systems and processes to scale out of it. Today, I find myself on the opposite side of the hype curve, just before the spike of enthusiasm that is driven by bringing a new service or product to market. A lot of fear was culminating around the worry that our product and service may not be received well, if at all. However, I’m most confident and experienced when the business is in the trough of sorrow, a stage where the ugliest feedback is coming in daily. Once I stepped into this frame of mind, everything “clicked” and I started focusing on launch – I signed up for a Shopify account, began reaching out to wholesalers and manufactures daily, began staging products on the site and we narrowed down the list of 3PLs used for warehousing.

With confidence renewed and our launch gaining momentum, we’re looking forward to an April launch. See below our income and expenses for February. It will be interesting to combine these reports at the end of the year and look at the actions that really moved the needle on our income or expenses.

Business Planning

Nomadica: Our initial strategy was to sell private label and proprietary products on Amazon and our own webstore. We spent February reviewing samples of private label products and had some specific design feedback for one product we’ve been working on since December. We originally planned to launch the product in April, and we’re still on track for this.

We also researched private label products and ordered samples from manufacturers. We won’t disclose what these are, as the private label strategy is based on discovering high-selling products on Amazon where the competition is not yet strong. As mentioned in the previous income statement, Scott Voelker and Gregory Mercer have great articles on how private labeling works.

After watching the documentary The True Cost, we realized that our purchase decisions as consumers and our business model as entrepreneurs will directly contribute to poverty and death if we don’t plan our supply chain very deliberately. In this vein, we decided to expand our strategy. Rather than only selling our own products on Nomadica.io, we committed to making Nomadica a total gear and clothing site for traveling families, featuring fair trade, ethically sourced, sustainable products. To this end, we designed our first Fair Trade product with a small team in Bolivia, and have established relationships with a number of leading brands in the Fair Trade clothing market.

To read about what’s involved in launching an ecommerce store that includes products we either manufacture, wholesale, or have dropship relationships with, stay tuned for our March Nomad Income Report. It’s not easy to find companies that even disclose their sourcing practices, let alone ask that these practices not contribute to impoverishment and pollution!

February Nomad Income Report 2016: Business

Trading: We made $360.81 in realized gains from trading and to be honest, one of the geckos that hang out our on our ceiling probably could have performed better. The world’s top oil-producing nations continued to play chicken with low prices, and it was the US who flinched first and began to wind down oil operations. Many of the OPEC nations agreed to a freeze on production at January levels, which actually yields a year-on-year increase for the months of Feb/Mar. I stuck to trading mostly gold and crude oil for the month, but regret the rate at which I traded. I day traded oil, trying to make small gains during daily fluctuations, and lost money. Gold continued to perform, and made up for the losses.

I also invested in Shopify, the ecommerce software that makes launching an online store easy. The company has only been publicly traded since May of last year, but has been operating since 2006. While we were in Chiang Mai, I was surprised at the number of Amazon Sellers adding Shopify channels to their product line. This makes complete sense, as it helps to have a strong selling channel outside Amazon if you’re ever going to sell your business. It was the sheer number of people moving toward the Shopify platform that impressed me. WordPress’s WooCommerce, Shopify’s biggest competitor, wasn’t mentioned once by the entrepreneurs at the FBA roundtable I attended. Again, I lost money trading too quickly, to the tune of $448. I expect to see some realized gains in May when Shopify’s next earning statement comes out.

Blogging: We made a total of, wait for it – $0.98 in advertising via Adsense, and $0.00 from Affiliates Amazon links. This meager amount was accumulated at the expense of our readers, who had to look at crappy ads. We have since removed Adsense from our blog and will only display static brand or service advertisements that are valuable to our audience.

Total Income: $360.80

February Nomad Income Report 2016: Expenditures

Accommodations: $341.65

Business: $1,827.15 (See below)

Child Care: $85.64 (We found a great daycare just 5 minutes by motorbike from our place. The ladies who run the daycare are as diverse as the kids who attend it, all of them lovely and caring. Woot!)

Clothing: $23.80 (Spencer is starting to grow out of his clothes and we found a great children’s clothing store in downtown Thongsala, 10 min from our house. Luckily, Sarah and I still fit into our clothes.)

Entertainment: $36.36 (We took Spencer to a few playgrounds, one in Koh Phangan charges for the day. We also went to KidsWorld in Penang, an amazing multi-story play gym for all ages.)

Gifts:$45.50 (A gift for a new mother, postcards, shipping)

Groceries: $346.15 (About the same as last month, yet we probably eat out less here than we did in Chiang Mai. Having a BLT in the morning to get the ‘ole ticker working overtime is nice now and again.)

Health & Beauty: $4.81 (Haircut in Penang)

Visa-Run: $860.58 (As US citizens, we’re required to exit Thailand every 60 days, even with our 6 month multiple entry visa. We used this as an opportunity to visit a country that we’ve never been to before. We chose Malaysia, and loved it – see Wish You Were Here: Penang, Malaysia)

Restaurants: $414.25 (Sarah and I eat out for lunch at work, drink coffee all day, and had a couple of expensive French meals when we were so depressed by the heeeeeeat.)

Motorbike Rental & Gasoline: $97.33 (We fill up about once a week, each time costing about $4.00)

Utilities: $178.41 (Electricity and mobile phone. Interesting hidden expense of low cost accommodation in a low cost country: we have to leave the AC on even when we’re not in the house, otherwise Spencer would be trying to sleep in 90 degree heat.)

Kindle Books: $58.15 (I think Sarah’s trying to break her previous year’s record 60 books.)

Miscellaneous: $48.22 (Bank fees & subscriptions)

Total Expenses: $4,368

Net Income: -$4007.20

Our largest expense was again Business, but we also had an almost $900 visa run. Ouch! Excluding these, we’re averaging $1350/month in living expenses. Thats pretty good for a family. Unlike last month, the majority of our business expenditures went toward product inventory, which should return a fair profit. In addition to the inventory order, we also ordered prototypes and paid for custom design work for a fair trade Nomadica t-shirt in our line.

While we kept living expenses as low as possible, we splurged in the amount of time we spent together, time we could have been using to get more business work done. If we’d been willing to make trade-offs here, we could have moved more quickly on the business.

Looking through the list, we feel OK with the expenses in the February Nomad Income Report and feel 90% of them were justifiable. We could have taken a ferry and then bus to Surat Thani to save $300 on our visa run, but the trip was long enough and we wanted it to be stress free. In terms of income, we could always use more but I learned some good lessons in trading that I wouldn’t have otherwise.

—

Wow! You really hung in there. Thanks for reading our February Nomad Income Report, and please reach out if your a nomad with a similar income report series.

Leave a Reply